Topics

Blog

Making Sense of Tax Form 1042-S for Reporting Income Paid

When filling out a 1042-S form, it's important to provide information about the source of the income being paid and the type of income being…

The Ins and Outs of 1040-NR for Nonresident Aliens and U.S. Expatriates

Nonresident Aliens and Tax Obligations I hear Canada's nice this time of the election cycle. Nonresident aliens are individuals who are not U.S. citizens or…

Capital Gains Taxes and the Key Inside the 28% Rate Gain Worksheet

What is the 28% Rate Gain Worksheet? The capital gains tax is a tax on profits from selling a capital asset. It applies to a…

The Major Deadlines for 1099s: When Your 1099 Forms Are Due

The due date for 1099 forms depends on the type of 1099 you are filing. Generally, Form 1099-MISC is due to the IRS and to…

What Every Senior Should Know About the 1040-SR Tax Form

The 1040-SR is a special tax form designed to help seniors file their taxes more easily. It was created as part of the Bipartisan Budget…

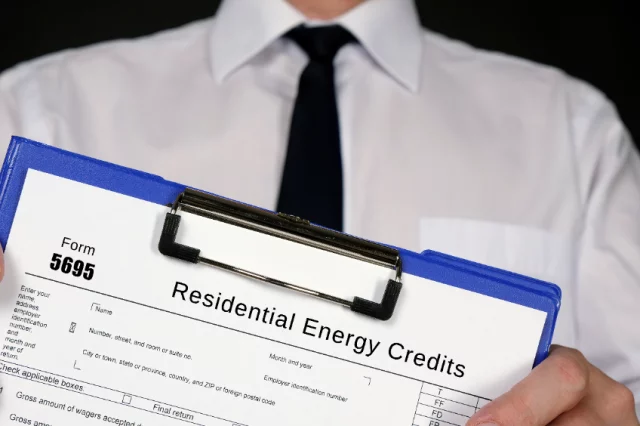

The Bright Spot in Your Taxes: How Form 5695 Lets You Claim the Solar Tax Credit

Filling out Form 5695 of the Internal Revenue Service (IRS) to claim the Solar Tax Credit is an easy process, but there are a few…

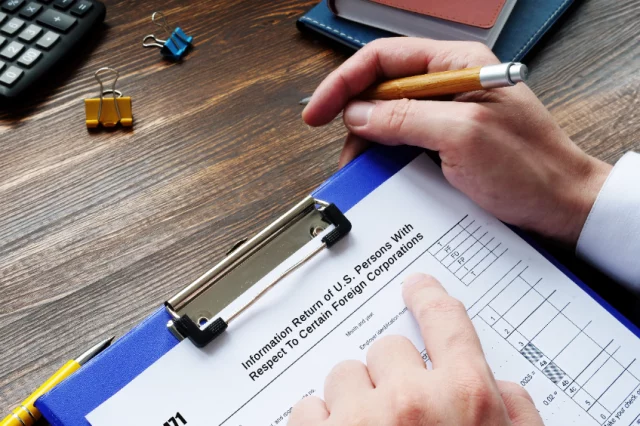

Taking Control of Your International Taxation with Form 5471

What is Form 5471? Are you a U.S. citizen or resident alien that owns or is involved in a foreign corporation? If so, then you…

What HOAs Need to Know About Form 1120-H

Form 1120-H Defined Homeowners associations and timeshare associations use Form 1120-H is a United for income tax returns. Taxable income is determined by subtracting deductible…