Tools & Forms

When Corporations File Taxes: Tax Form 1120 and Form 1120-S for Corporation Income Tax Returns

Yes, corporations do file income tax returns. No, pigs still don't fly. When you, as a corporation, file taxes, you must use Form 1120…

What Form 1099-R Means For Your Retirement: Pensions, IRAs, Retirement or Profit-Sharing Plans

The R stands for Retirement. The 1099 stands for "Pay your fair share, even if you're retired.' Form 1099-R is an important document that…

How IRS Exchange Rates Work When Converting Foreign Currencies to US Tax Dollars

Uncle Sam wants you to pay your taxes -- but only with US dollars, please. Taxpayers who earn income in a foreign country or financial…

The Only Official IRS Penalty Calculator Is an Accurate Tax Return

A fast tax penalty calculator? It's the IRS, not hockey. You need to accurately calculate your annual tax returns to avoid any potential penalties and…

Want Credit for Saving With Qualified Retirement Plan Contributions? Then Use Form 8880

You know those score multipliers in pinball? Saving for retirement is kinda like that. Are you looking to claim the Retirement Savings Contributions Credit, also…

How to Get a Copy of W2 Fast

If you're searching for your W2 quickly for a variety of reasons, whether it's a third party request, trying to qualify for a loan, or…

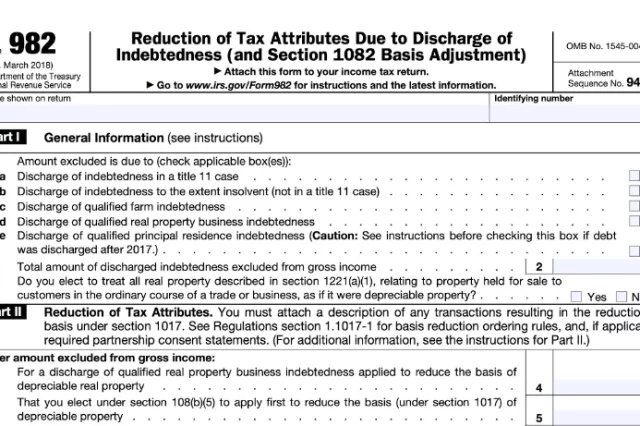

Form 982

Did you get any debts canceled or forgiven this year? You may need IRS tax form 982. Claiming insolvency with form 982 can let…