Tools & Forms

The 1040 Is Already Easy: Why There Is No 1040 EZ for 2023

EZ come, EZ go. Filing income taxes can be a daunting task, but luckily, the IRS provides various tax forms to cater to different taxpayer…

How IRS Affidavit Form 14039 Can Protect You From Identity Theft

I mean, I wish my tax refund were big enough that I could be a target of tax refund theft. IRS Identity Theft Affidavit Form…

How Do I E-File? Electronically Submit Tax Returns, 1099s and More

Even the IRS prefers e-filing, and they love paperwork! How to E-File Your Tax Returns E-filing (or electronic filing) is a convenient and efficient way…

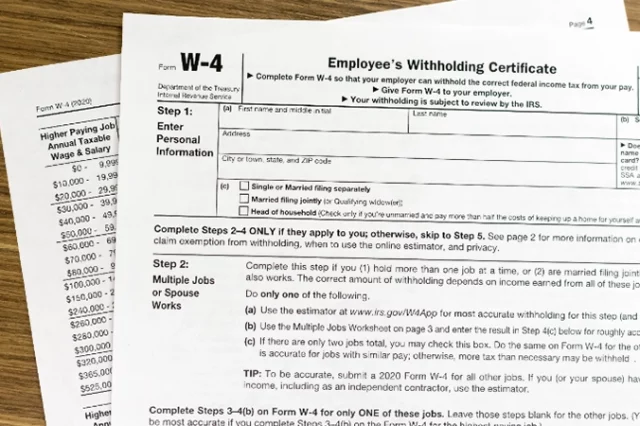

Making Allowances for Dependents: How Do I Claim a Dependent on My Form W-4 for Tax Year 2023?

Very Important: The allowance on W-4 is not like an allowance from your parents. Accurately claiming dependents on your W-4 form is crucial for ensuring…

Who’s Got Control of the Control Number on W2 Forms?

So this is like "quality control" but for my income taxes. Better than "Inspected by No. 12." Your W-2 form is a crucial document when…

How to Navigate the (Slightly Simpler) Alternative Tax System: The Alternative Minimum Tax Calculator

There's an alternative to regular taxes? Yeah, paying more. Alternative minimum tax (AMT) is a tax system implemented in the United States to ensure that…

Which 990 Form Should My Tax-Exempt Organization Use?

You might be exempt from taxes, but no one's exempt from paperwork! What is IRS Form 990 and why is it important? IRS Form 990…

What’s The Right Way To Use Tax Form 540, California Resident Income Tax Return

Look! It's the tax form all the movie stars use! What is the IRS 540 Tax Form? The IRS 540 tax form, also known as…