Tax Deductions

Can I Deduct My 529 Contributions on My Federal Tax Returns?

Definition of 529 Contributions I think I might start a 529 just for the tax benefit! A 529 plan is an educational savings plan that…

How Long Can You Claim a Child as a Dependent?

Claiming your child as a dependent can provide significant financial benefits, including tax credits and deductions. However, as your children grow older and start to…

Can I Claim my Adult Child as a Dependent?

Parents who have adult children who still depend on them financially may wonder if they can claim them as dependents on their tax returns. In…

2022 Federal Income Tax Brackets, Rates, & Standard Deductions

What are tax brackets? The United States has what is called a progressive income tax system, meaning the greater your income, the more you pay.…

Tax Preparation Tips for Filing Your 2021 Return in 2022

Get Ready to File Your 2021 Federal Tax Return By April 18, 2022 The 2022 tax filing season us coming up, so it’s time to…

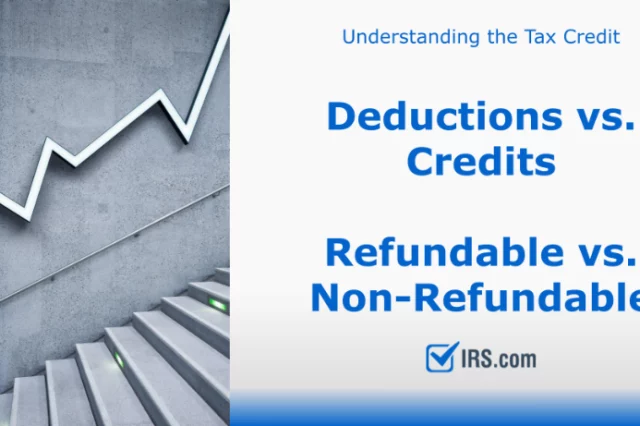

Should You Itemize Your Deductions?

Tax Tips for Claiming Itemizing Deductions vs. the Standard Deduction When you are filing your 1040 tax return, right before you compute your final taxable income, you…

Understanding The Standard Tax Deduction

Claim the Standard Deduction on Your 1040 Return to Lower Your Income Tax Liability Are you going to take the standard tax deduction, or will…