Tax Deductions

When You’re Filling out Your W-4, How Many Exemptions and Allowances Should You Claim?

Withhold taxes now or owe taxes next April? [insert superhero tough decision meme] When filling out your W-4 form, it's important to carefully consider how…

Where to Find Your Amended Tax Return, Using the IRS Where’s My Amended Return Online Tool

It’s really called the “Where’s My Amended Return Tool”? Well, the IRS isn’t subtle. If you’ve recently amended your original tax return and are wondering…

Is Child Support Taxable Income or Tax Deductible? No

Child support might be tax neutral, but it's rarely feelings neutral. Child support is tax neutral for both the paying and receiving parents. Child support…

No, There Is No First-time Homebuyer Tax Credit With the IRS

Yeah, the tax credit isn't real. Maybe Santa will bring us one. Oh, wait... Sorry, there is no first-time home buyer tax credit available, as…

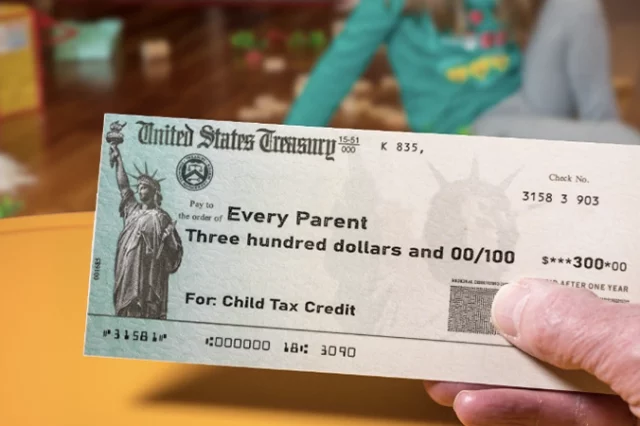

What Every Parent Needs to Know About the Child Tax Credit (and the Update Portal)

Just because the monthly check is gone, the tax credit isn't. Parents should be aware that the Advance Child Tax Credit payments, which were monthly…

Funeral Expenses That Are (and Aren’t) Tax Deductible

Death and taxes might be certain, but funeral expense tax deductions are a little less so. Funeral expenses can be a substantial burden on families,…

The 2023 Child Tax Credit Payment Schedule: Only Annual Tax Credits (For Now)

If you're looking for a "payment schedule" to your child credit, well, the good news is there still is a child tax credit. The Child…

Advance Premium Tax Credit: How the Federal Government Can Help Individuals Pay for Health Insurance

The APTC does real good for families, but in a very IRS-meets-health insurance kind of way. Talk about two institutions who share a love of…