Evaluate Your Payroll Withholdings

Published:

Whether or not you should adjust your payroll withholdings is a big question. If you owed a lot of taxes with your final return or you received a large tax refund, it may be time to adjust your withholdings. Of course, this is easier said than done. To ensure accuracy, you should use a tax calculator.

With the right tax calculator you can evaluate your payroll withholdings, and in turn, make the proper changes. The tax calculator below can help you assess your withholding situation.

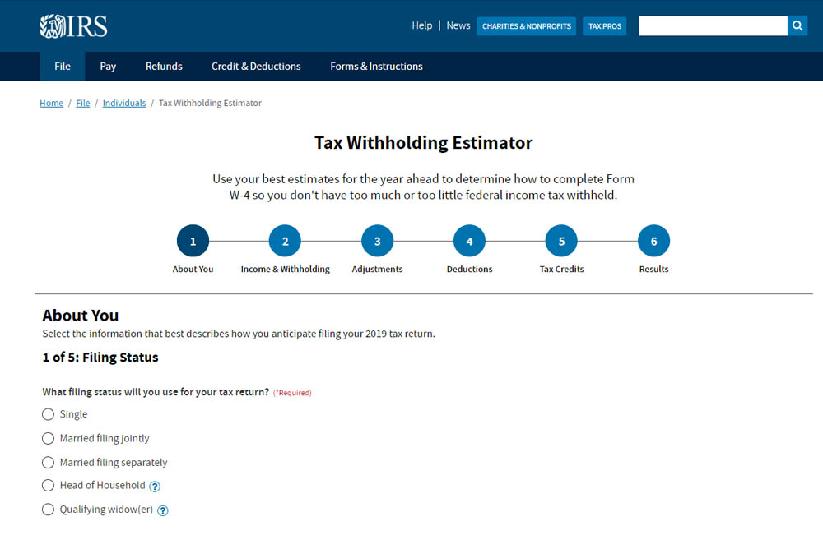

TAX CALCULATOR: Should I Adjust My Payroll Withholdings?

By using this Payroll Withholdings Tax Calculator, you can determine whether you are paying too much or too little in withholding taxes. The results of the calculator will allow you to make the proper adjustments to your W-4, so you can more closely match what you actually owe. If you find that you have been paying too much over the years, you may be able to make a few basic adjustments which will increase the overall amount of your take-home pay.

There are 9 parts to this tax calculator, which ask for your income and tax information:

Part 1 ? Tax Filing Status

Choose from ‘Single,’ ‘Head of Household,’ ‘Married ‘ Separately,’ and ‘Married ‘ Jointly.’ Enter the status that you use on your income tax return into the tax calculator.

Part 2 ? Gross Annual Income

Enter the dollar amount of your AGI.

Part 3 ? Qualified Plan/IRA Contribution

Enter the dollar amount that was contributed to your qualified retirement plan.

Part 4 ? Itemized Deductions – $0 for Standard

Enter the dollar amount of your itemized deductions into the tax calculator. This number should match what you reported on your income tax return.

Part 5 ? Number of Personal Exemptions

Enter the number of personal exemptions you claimed on your income tax return.

Part 6 ? Number of Dependent Children

Enter the number of children you claimed as dependents on your income tax return.

Part 7 ? Federal Taxes Withheld to Date

Enter the amount of federal income taxes that have been withheld from your wages.

Part 8 ? Number of Allowances Claimed on W-4

Choose a number from 0 to 25.

Part 9 ? Payment Frequency

Choose from ‘Weekly,’ ‘Bi-Weekly,’ ‘Semi-Monthly,’ ‘Monthly,’ and ‘Annually.’

Once you fill your information into the payroll withholding tax calculator, click ‘Submit’ to see your results.

Your results will include lines such as ‘taxes yet to be withheld’ and ‘total taxes withheld/to be withheld.’ These phrases mean it will eventually lead to a tax shortfall or overpayment.

Along with a final number, the tax calculator will also tell you what you can do to fix your withholding situation. For instance, if you have a shortfall, the tax calculator may suggest: ‘Consider decreasing the number of tax allowances you are claiming in order to more closely match your estimated tax liability.’

Withholding too much or not enough taxes from your wages can cause unnecessary stress when tax season rolls around. Although it is tricky, your should want to withhold about same amount that you’ll owe in tax. That way, you receive as much money as possible from each paycheck, without owing more at the end of the year.

Using a tax calculator can help you get a better idea of where you stand, as well as which adjustments you may need to make to improve your situation. With the right information on-hand and a good tax calculator, you can evaluate your payroll withholdings within a matter of minutes.