Topics

Blog

Pilot IRS Direct File Program a Success: Taxpayers Get $90 Million in Refunds

The Internal Revenue Service has just announced on X (formerly Twitter) that it has officially closed down the pilot IRS Direct File program, with over…

The IRS Just Became 1 Billion Dollars Richer

In April, the IRS warned nearly 1 million taxpayers that they may be leaving more than $1 billion on the table because they never filed…

The Credit for Employer-Provided Childcare Facilities

Providing Childcare For Your Employees? You may qualify for a huge credit The Credit for Employer-Provided Childcare Facilities is tax credit that encourages employers to…

When Corporations File Taxes: Tax Form 1120 and Form 1120-S for Corporation Income Tax Returns

Yes, corporations do file income tax returns. No, pigs still don't fly. When you, as a corporation, file taxes, you must use Form 1120…

How to Read Tax Transcripts: Find Your Refund Date on Your Tax Transcript

There's a lot of data in your tax transcript codes. Understanding them is like reading The Matrix. You may have received a tax transcript…

What Form 1099-R Means For Your Retirement: Pensions, IRAs, Retirement or Profit-Sharing Plans

The R stands for Retirement. The 1099 stands for "Pay your fair share, even if you're retired.' Form 1099-R is an important document that…

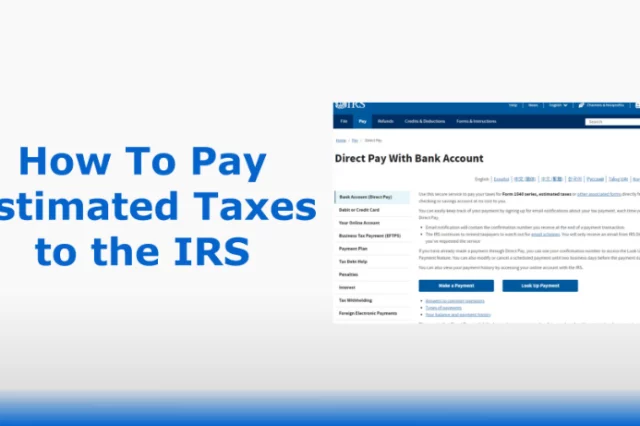

Opinion: The Future of Artificial Intelligence Tax Preparation Is (Not Quite) Here

What happens when computer code meets the U.S. tax code? One of the fastest ways to turn the drudgery of tax filing into a mess…