Deducting Investment Interest

Published:Over the years, many new types of investment vehicles have emerged. The good news is that the interest paid on money used to generate income from investments is generally tax-deductible against taxable investment income. The bad news is that many people are confused by what qualifies as ‘investment interest’ and they fail to consult a qualified tax professional for guidance, thus losing out on taking this deduction.

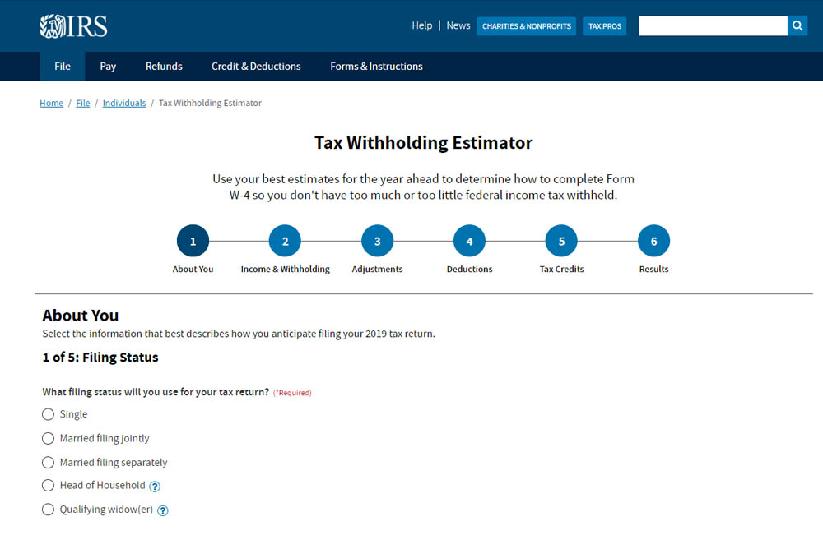

Determining what is deductible as investment interest can be a bit tricky since there are a number of rules outlined by the IRS. But using a tax calculator can help.

The ‘Will My Investment Interest Be Deductible?‘ Tax Calculator can help you calculate how much deductible investment interest applies to your tax return from typical investment activity.

As the tax calculator indicates, the IRS will generally let you deduct (as an expense) the interest you paid to produce taxable income in order to offset the taxes that would be otherwise due from taxable dividend, interest, and short-term capital gains distributions paid to you. Any remaining investment interest expense that is greater than your taxable investment income can be carried over (a.k.a. ‘rolled over’) for use in future years.

How to Use the Tax Calculator

You will need to enter your marginal tax bracket into the tax calculator, which is based on your filing status and gross income level (shown on the pop-up table). To calculate your taxable investment income, first enter your ordinary dividends in the ‘Dividends Income’ field on the tax calculator. Ordinary dividends are the most common type of distribution from a corporation and are taxable as ordinary income unless they are qualified dividends.

Next, enter your taxable interest income in the ‘Interest Income’ field of the tax calculator, and then enter your short-term capital gains (from investments held for one year or less) in the ‘Short-Term Capital Gains’ section.

Now enter your qualified margin interest in the ‘Margin Account Interest’ section of the tax calculator. In most cases, the interest income tax deduction is taken by people who buy securities on margin. Margin is simply another word for ‘credit’ and it refers to money loaned by a brokerage firm to clients who wish to buy stocks, bonds, or other eligible securities without having to pay the full price in cash. The brokerage firm charges the client interest each month on their outstanding loan balance. A client may borrow against the securities in his/her account and use that money for whatever reason. However, it is only the interest that is paid on the loan that is used to invest in securities (or other income-producing investments) that is tax-deductible. For example, if a client uses all or part of the money borrowed to take a vacation or to buy an appliance, the interest on that amount is NOT considered tax-deductible.

In the ‘Other Investment Interest’ field on the tax calculator, enter the total amount of interest you paid from non-margin interest investments that produced income. This may include interest paid on a loan to invest in a company, buy land, or purchase other non-rental property that you bought as an investment. You should consult a qualified tax professional if you are uncertain about what to enter in this section.