E-Filing Taxes

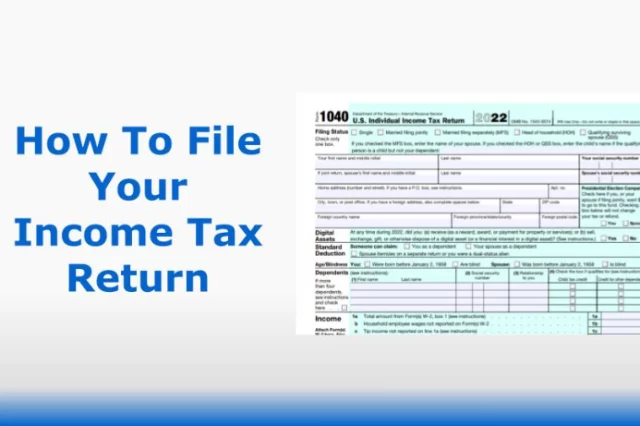

The 1040 Is Already Easy: Why There Is No 1040 EZ for 2023

EZ come, EZ go. Filing income taxes can be a daunting task, but luckily, the IRS provides various tax forms to cater to different taxpayer…

How Do I E-File? Electronically Submit Tax Returns, 1099s and More

Even the IRS prefers e-filing, and they love paperwork! How to E-File Your Tax Returns E-filing (or electronic filing) is a convenient and efficient way…

File a Business Tax Extension Online

Business Taxes Are Due Tuesday, March 15, 2016 The IRS allows both individuals and businesses to file for a tax extension, which gives you…

Which Tax Form Should You File?

Federal Tax Returns Have Undergone Several Changes Over the Past Few Years There used to be several different versions of the federal individual income tax…

7 Critical Facts About Itemizing And Using Free Filing Services

As tax season fast approaches, most of us are starting to consider our options when it comes to filing. With all the changes in tax…