Tax Preparation

What Is Tax Form 4835: What It Is And How To Use It

If you own farmland that someone else operates, you might be wondering how to report your income from that arrangement come tax time. That’s where…

Form 944: The Annual Payroll Tax Return for Small Employers

If you're a small business owner or a new employer in the U.S., the IRS has a form specifically designed to help you simplify your…

How IRS Exchange Rates Work When Converting Foreign Currencies to US Tax Dollars

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2025/03/IRS_Exchange_Rates_Explained_for_Expats.mp4"][/video] Taxpayers who earn income in a foreign country or financial assets in foreign currencies must report their earnings and assets in…

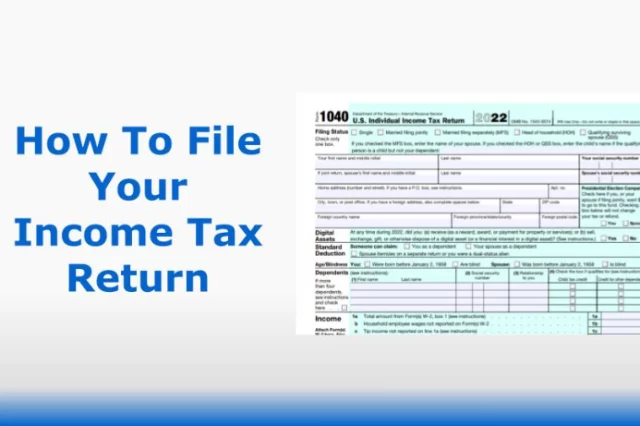

Tax Preparation Checklist

What You Need to File Your Taxes in 2022 Preparing your tax return requires a lot of information, so it’s a great idea to have…