Tax Forms

What’s The Right Way To Use Tax Form 540, California Resident Income Tax Return

Look! It's the tax form all the movie stars use! What is the IRS 540 Tax Form? The IRS 540 tax form, also known as…

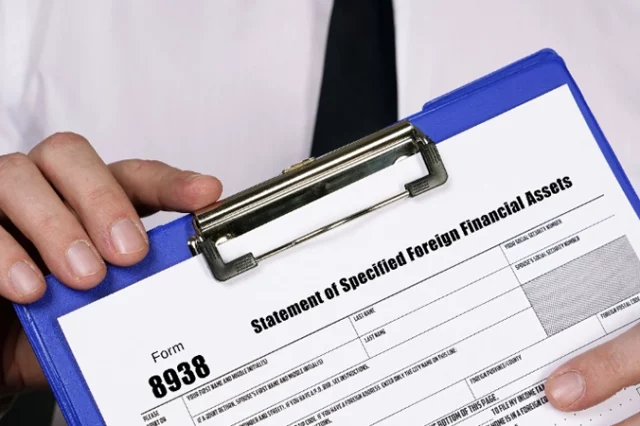

Foreign Accounts and Financial Assets with Form 8938: The Facts on Complying With FATCA

So all those Bond villains with Swiss bank accounts still pay taxes? With this form, yes. What is Form 8938? Form 8938 is a requirement…

How Can You File Taxes Without a W-2 Form? It’s Possible, and Here’s How to Do Your Taxes Without a W-2

So the ol' "Dog ate my W-2" excuse won't work? Filing your taxes can be a daunting task, especially when you do not have all…

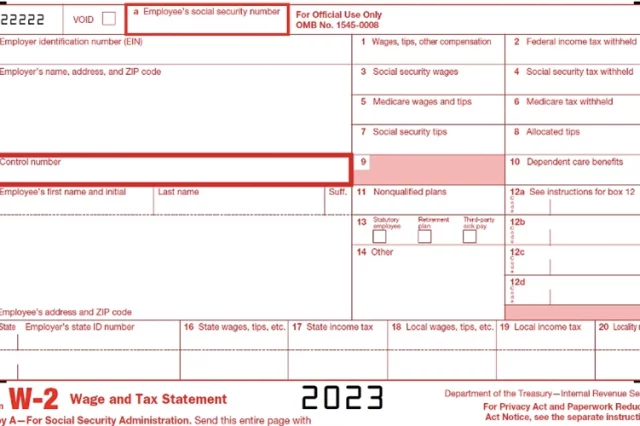

Big Questions, Small Form: What’s Box-D on Form W-2? Where Is It, What’s It for, and Can It Be Left Blank?

Is there a name for hypochondria about your tax forms? I've wondered about Box D on W-2, but now, I don't! Box D on Form…

Tax Teamwork: Instructions for Partnerships Using Form 1065 on Their Federal Tax Returns

They say partnership is hard. Then comes along Form 1065. Before diving into the details of 1065 instructions, it’s important to understand the context behind…

I Got a 5071C Letter, Now What?

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2023/05/Understanding_Your_5071C_Letter1.mp4"][/video] When the IRS sends you a 5071C letter, that’s a request for you to verify your identity. You’re probably getting one…

What Business Owners and Employers Should Do When The IRS Gives Them a 147c Letter

Understanding Your Specific IRS Letter 147c IRS Letter 147c is an official form of verification issued by the IRS (Internal Revenue Service) that confirms the…

Rejoice, Employers! You Can File Your 1099 Tax Forms Online

The miracle of the Internet Age meets business tax compliance. Form 1099-MISC is an IRS tax form used to report miscellaneous payments made to independent…