Small Business Taxes

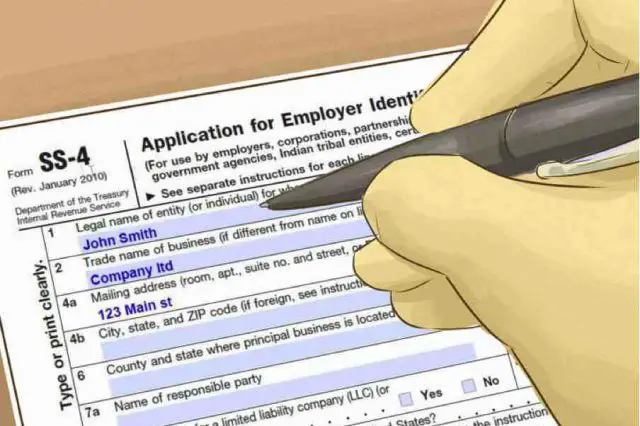

How to Get an LLC and EIN (Tax ID Number)

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2025/03/LLC_and_EIN_Setup_Guide.mp4"][/video] Steps for Obtaining a Tax ID Number from the IRS Obtaining your EIN Number for an LLC can be done fairly…

Information About Employer Identification Numbers (EINs)

IRS Requirements & How to Apply for an EIN An Employer Identification Number (EIN) is a 9-digit number issued by the IRS for the purposes…

Income Tax Extensions Explained

Nearly everyone knows that April 15 is the deadline for submitting tax returns in the United States. Although some entities may need to file before…

Tax Form 1099-MISC: Miscellaneous Income

Reporting Miscellaneous Income and Payments to the IRS Form 1099-MISC is an information return used to report certain miscellaneous income/payments to the IRS. If…

Business Taxes: Important Due Dates

In general, all businesses operating in the U.S. are required to report their activities to the IRS by filing annual tax returns. The due date…

5 Tax Deductions for Businesses

Beyond normal day-to-day business expenses, there are many other tax deductions that can help business owners reduce their tax liability. Not using all the deductions…

Tax Tips for Independent Contractors

Information for Self-Employed Persons For Federal income tax purposes, it is important to know whether you are an employee or an independent contractor. Employee…