Tax Deductions

The Benefits of Filing Your Taxes Online

Why You Should E-File This Year There are many benefits to filing your taxes online (also called “electronic filing” or “e-file”). Once you are familiar…

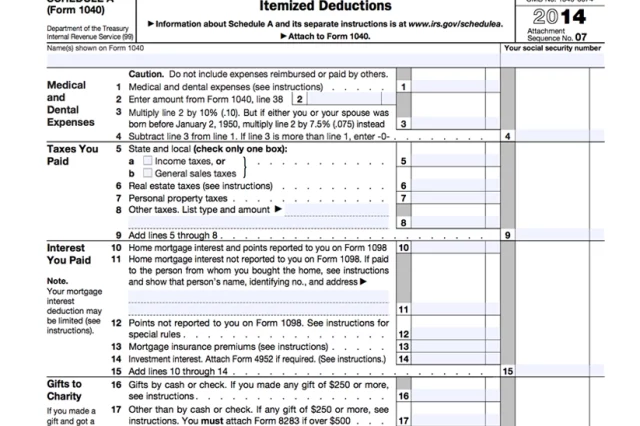

Top 5 Most Popular Itemized Deductions for U.S. Taxpayers

[video width="1280" height="720" mp4="https://www.irs.com/wp-content/uploads/2015/10/Top_5_Tax_Deductions_Explained1.mp4"][/video] Itemizing your tax deductions can decrease your taxable income by a sizable amount, but you can’t just choose whatever expenses…

Life Events That Can Impact Your Taxes

A change in life circumstances, whether good or bad, can affect your tax return. >> Start Your FREE E-file Here are some instances where you will…

How Does a Health Savings Account (HSA) Work?

Offset Health Care Costs With an HSA Health Savings Accounts (HSAs) are designed to help individuals offset the health care costs associated with High…