Calculating Tax on Social Security Benefits

Published:Are you set to receive Social Security benefits in the near future? This is an exciting time in your life. While it’s a good thing, you have to consider the taxes that you may be required to pay on Social Security benefits. Will you really be receiving as much money as you thought? Or will you end up paying out a lot in taxes, leaving you with a smaller monthly benefit?

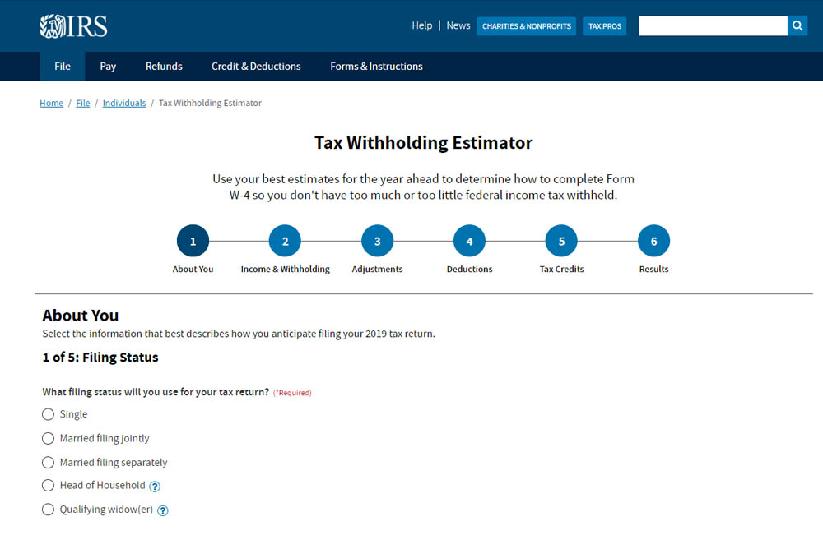

One of the best ways to determine what you will owe on your Social Security benefits is with a tax calculator. The right tax calculator can help you determine how much tax you will owe, while giving you a better idea of what goes into the overall calculation.

TAX CALCULATOR: How Much Of My Social Security Benefit May Be Taxed?

Using the above tax calculator is quite simple as long as you have the right information on-hand. There are 3 main sections to this tax calculator:

Tax Calculator Section 1: Income and Tax Information

‘ Tax Filing Status ? Choose from Single, Head of Household, Married Filing Jointly, Married/Separately/Living Together, or Married/Separately/Living Apart

‘ Marginal Tax Bracket ? Your federal income tax bracket, as a percentage

Tax Calculator Section 2: Calculating ‘Modified’ Adjusted Gross Income

‘ Long-Term Capital Gains/Losses ? On assets held for over a year

‘ Short-Term Capital Gains/Losses ? On assets held for a year or less

‘ Dividends ? As a dollar amount

‘ Taxable Interest ? As a dollar amount

‘ Tax-Free Interest ? As a dollar amount

‘ Pension Benefits ? As a dollar amount

‘ IRA Distributions ? As a dollar amount

‘ Roth IRA Distributions ? As a dollar amount

‘ Other Taxable Income ? As a dollar amount

‘ Wages ? As a dollar amount

‘ Self-Employed Income/Loss ? As a dollar amount [See related article ‘Calculate Your Self-Employment Tax‘]

‘ Deductible IRA Contributions ? As a dollar amount

Tax Calculator Section 3: Social Security Benefits

‘ Social Security Received ? As a dollar amount

This may appear to be a lot of information, but there is a very good chance that you have it all on file. Remember, the more accurate your numbers are, the more accurate the tax calculator results will be. That being said, also don’t be afraid to experiment with the Social Security Tax Calculator. At the very least, you can get an general idea of how much tax you will owe on your social security benefits.

Once all of your numbers are in the proper fields, click ‘Submit’ and the tax calculator will generate your results. Keep in mind, some people find that they owe no taxes on their Social Security benefits. However, you should note that the IRS may tax up to 85% of Social Security income.

In addition to learning how much you owe to the IRS, a tax calculator can also help you reconfigure your other income to minimize your tax liability. By shifting around other investments, you may be able to lower the amount of tax that you pay on your Social Security benefits.

By using a good tax calculator, you can quickly and efficiently determine how much taxes you will owe on Social Security benefits. Along with this, you will get a better idea of how your other investments and income effect your overall financial situation.