Tax Forms

When Corporations File Taxes: Tax Form 1120 and Form 1120-S for Corporation Income Tax Returns

Yes, corporations do file income tax returns. No, pigs still don't fly. When you, as a corporation, file taxes, you must use Form 1120…

What Form 1099-R Means For Your Retirement: Pensions, IRAs, Retirement or Profit-Sharing Plans

The R stands for Retirement. The 1099 stands for "Pay your fair share, even if you're retired.' Form 1099-R is an important document that…

Want Credit for Saving With Qualified Retirement Plan Contributions? Then Use Form 8880

You know those score multipliers in pinball? Saving for retirement is kinda like that. Are you looking to claim the Retirement Savings Contributions Credit, also…

How to Get a Copy of W2 Fast

If you're searching for your W2 quickly for a variety of reasons, whether it's a third party request, trying to qualify for a loan, or…

Form 982

Did you get any debts canceled or forgiven this year? You may need IRS tax form 982. Claiming insolvency with form 982 can let…

Caught In the Net Investment Income Tax? When to File Form 8960

Excited about passive income? So were we, until we got to the NIITy gritty. Form 8960, also known as the Net Investment Income Tax Individuals,…

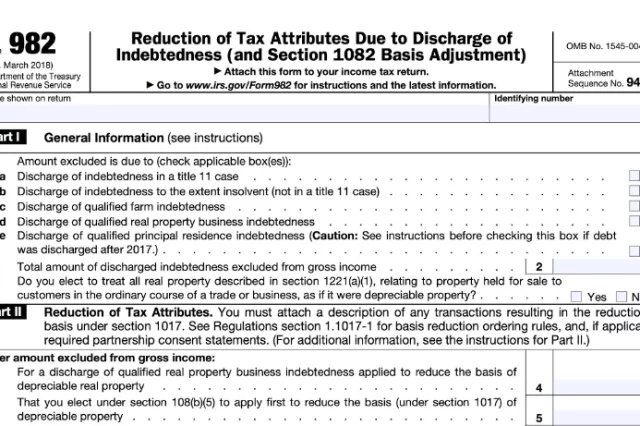

How Does Form 8992 Work? Round-the-world Tour of Global Intangible Low-Taxed Income (GILTI)

It's not that kind of guilty, your honor. Form 8992 is an essential IRS tax form that requires U.S. shareholders of controlled foreign corporations (CFCs)…

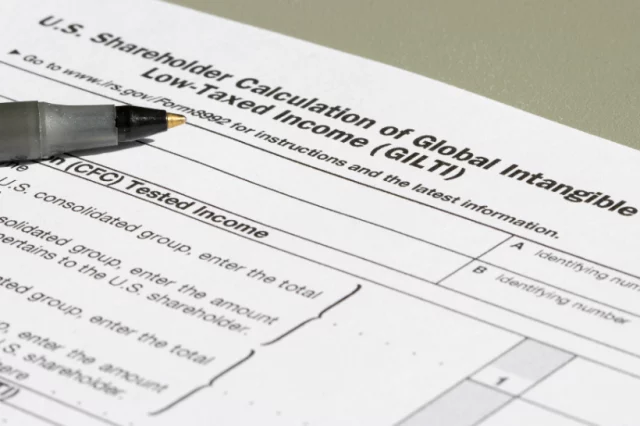

The Business End of Form 945: Nonpayroll Payments and the Annual Return of Withheld Federal Income Tax

Gambling with nonpayroll withheld taxes? Grab form 945 instead. Form 945, Annual Return of Withheld Federal Income Tax, is a tax form used by businesses…