Understanding the Different Types of Individual Income Tax Returns

Published:

There are several different types of Federal individual income tax returns. You must use the tax form that corresponds with your particular situation and allows you to claim the income, tax deductions, tax credits, etc. that apply to you. Federal income tax returns are generally due by April 15th, unless you are approved for a tax extension.

The most common types of income tax returns include the following:

- Form 1040 (U.S. Individual Income Tax Return) (a.k.a. “the long form”)

- Form 1040A (U.S. Individual Income Tax Return) (a.k.a. “the short form”)

- Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents)

- Form 1040NR (U.S. Nonresident Alien Income Tax Return)

- Form 1040NR-EZ (U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents)

IRS Tax Form 1040 (U.S. Individual Income Tax Return)

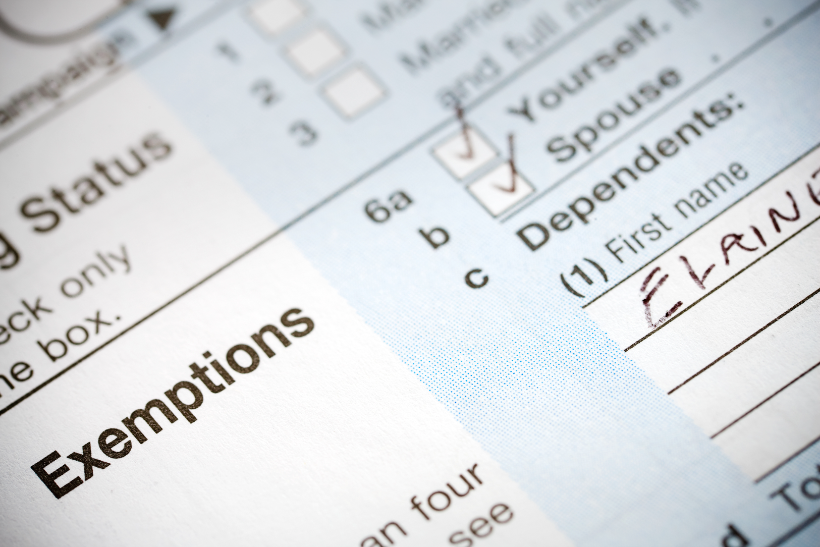

Form 1040 is the standard Federal income tax form used to report an individual’s gross income (e.g., money, goods, property, and services). It is also known as “the long form” because it is more extensive than the shorter 1040A and 1040EZ Tax Forms. Also unlike the other tax forms, IRS Form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions, and adjust income.

While the 1040 may take longer to complete, it benefits taxpayers by giving them more opportunities to lower their tax bills. But before you start to prepare your 1040 tax form, you should first check to see if you qualify to use the simpler 1040A or 1040EZ tax forms. However, it is a safe bet to use IRS Form 1040 if you are unsure whether or not you are eligible to use the 1040A or 1040EZ. The basic rule of thumb is this: When in doubt, file Tax Form 1040.

Form 1040A (U.S. Individual Income Tax Return)

IRS Tax Form 1040A is a simplified federal income tax form used to report an individual’s income and calculate their taxes. It is also known as “the short form” because it is a two-page form that is less complex than IRS Tax Form 1040. Tax Form 1040A covers more than Form 1040EZ (see below) and it allows taxpayers to report common types of income, tax credits, and tax deductions.

The 1040A Form is available to taxpayers of any age and any filing status, however, you cannot itemize your deductions and the types of tax credits you can claim are limited. If you qualify to use Form 1040A, it will take you less time to prepare (than the longer 1040 tax form) and it will likely be processed faster by the IRS. While most people qualify to use the 1040A tax form, it is not as extensive as its longer counterpart, so it’s a good idea to look over what the 1040 tax form offers first.

Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents)

IRS Tax Form 1040EZ is the shortest federal individual income tax form. It is designed for taxpayers whose filing status is “single” or “married filing jointly” with no dependents. The 1040EZ is less complex than Tax Form 1040 and Tax Form 1040A, so it generally takes less time to fill out and process.

However, depending on your situation, it may be more beneficial for you to use Form 1040 or Form 1040A instead, since those forms allow taxpayers to claim “head of household” status (which typically results in a lower tax than filing as “single”), dependents, and various tax credits, tax deductions, and adjustments to income.

Form 1040NR (U.S. Nonresident Alien Income Tax Return)

IRS Tax Form 1040NR is the Federal individual income tax return for non-resident aliens. This tax form is similar to the regular 1040 form used by U.S. citizens. Form 1040NR must be filed if you were a nonresident alien during the past tax year who engaged in business in the U.S.. You are required to file even if you have no income from the business, or your income is exempt from tax under a treaty with your country.

You must also use this form if you were a nonresident alien who did not engage in U.S. business, but received income from U.S. sources that are reportable on Schedule NEC. Note that United States citizens never have to file Tax Form 1040NR. But if you are a U.S. nonresident alien, this is a tax form that you should become familiar with.

Form 1040NR-EZ (U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents)

IRS Tax Form 1040NR-EZ is the “short form” version of Form 1040NR (see above) designed for taxpayers who are non-resident aliens. In other words, this is the simpler version of the 1040NR which is for the same group of people. Keep in mind, there are certain requirements if you want to use Form 1040NR-EZ to report your annual income taxes. For example, you cannot claim any dependents and you cannot be claimed as a dependent on someone else’s income tax return.

Individual Income Tax Return — Preparation and Filing

There are many different ways to obtain an individual income tax return. The fastest and most convenient option is to download the tax form on your computer. Most post offices and local libraries carry forms around tax time, and forms can also be picked up from a tax center or an IRS office. In addition, you may request a tax form to be sent to you by U.S. Mail.

Before you begin filing your individual income tax return, make sure you have the following information ready:

- Proof of identification

- Filing status and residency status

- Social Security Numbers for you, your spouse, and any dependents

- Dates of birth for you, your spouse, and any dependents

- A copy of your past tax return

- Statements of wages earned (e.g., W-2, W-2G, 1099-R, etc.)

- Statements of interest/dividends from banks, brokerages, etc.

- Proof of any tax credits, tax deductions, or tax exclusions

- Your bank account number and routing number (for Direct Deposit)

Federal individual income tax returns are due with payment by April 15th. A 6-month tax extension may be granted (with IRS Tax Form 4868) for late filing. However, it is important to understand that there are no extensions for tax payments. So whether or not you obtained a tax extension to file your return, any tax due must still be paid by the original filing deadline (April 15th).

READ: Tax Extensions for Individuals

You may file your Federal income tax return by paper mail, via electronic filing (a.k.a. “e-filing”), through the IRS’s Free File program, or by employing a professional tax preparer.

Filing taxes online is generally safer, faster, and easier ? and you will get your tax refund much sooner if you choose the Direct Deposit option.

READ: When Will My Federal Tax Refund Arrive?