Which Tax Form To File Now That 1040A & 1040EZ Are No Longer Used?

Published:Prepare your tax return at E-file.com

File your IRS taxes online quickly & accurately in just minutes with E-file.com.

What is IRS Form 1040

The Internal Revenue Service Form 1040 is the standardized official document that individual taxpayers (most U.S. citizens and permanent residents who work in the U.S.) use to file their income tax returns. Form 1040 contains sections where taxpayers disclose the taxable income made for the year to determine if they owe additional taxes or are eligible for a tax refund.

You must file a tax return if you are single or married filing separately and making over $12,550 while under the age of 65, or over $14,250 if ages 65 or older.

However, even if you did not make this amount, it is still advisable to file federal tax returns to get a refund. This could apply if you:

- Have had federal income tax withheld from your pay

- Made estimated tax payments

- Qualify to claim tax credits such as the Earned Income Tax Credit and Child Tax Credit

IRS Form 1040 needs to be filed as part of your tax return preparation with the IRS by the federal deadline, which is usually April 15th to avoid a late filing penalty.

What You Need to Know About the New 1040 Return

In June 2018, the IRS announced it was taking steps to streamline and simplify the income tax return process. This overhaul was part of the Tax Cuts and Jobs Act (TCJA), which was signed into law by former President Trump on December 22, 2017.

Beginning tax year 2019, Forms 1040A and 1040EZ were eliminated altogether and replaced with a condensed, postcard-sized version for all taxpayers to use – with additional forms called Schedules to attach if needed.

What are the different types of 1040 forms now that 1040A & 1040EZ Are No Longer Used?

There are four types of Tax Form 1040 to file, depending on your situation.

- Form 1040: Most taxpayers should use this form to report taxable income and determine their annual tax, as well as if they are eligible for a refund or owe additional taxes.

- Form 1040-SR: Form 1040-SR is nearly identical to Form 1040, but is used for senior taxpayers aged 65 and older. 1040-SR is printed with a larger font and includes a chart for determining the taxpayer’s standard deduction.

- Form 1040-NR: For those who are not United States citizens and do not have a green card, this form is an extended version of Form 1040 with several extra pages.

- Form 1040-X: Form 1040-X is for taxpayers that need to amend their original return after previously filing a Form 1040 to the IRS.

The New Postcard-Sized 1040 Return

U.S. Treasury Secretary Steven T. Mnuchin stated, “The new, postcard-size Form 1040 is designed to simplify and expedite filing annual income tax returns, providing much-needed relief to hardworking taxpayers.” The simplified Form 1040 consolidates the three older versions of the 1040 return (Forms 1040, 1040A, and 1040EZ) into one form.

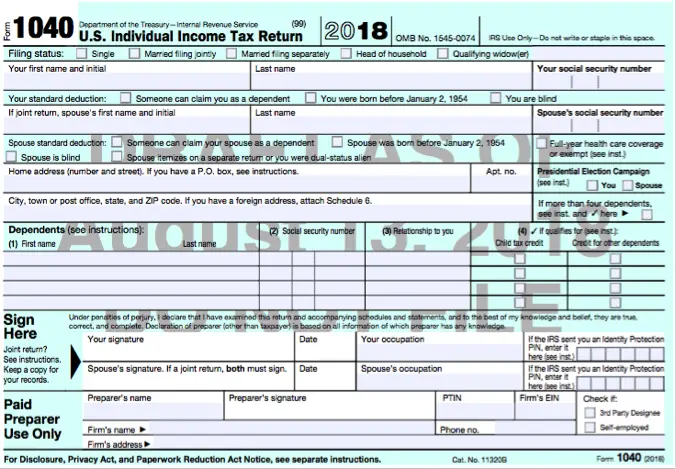

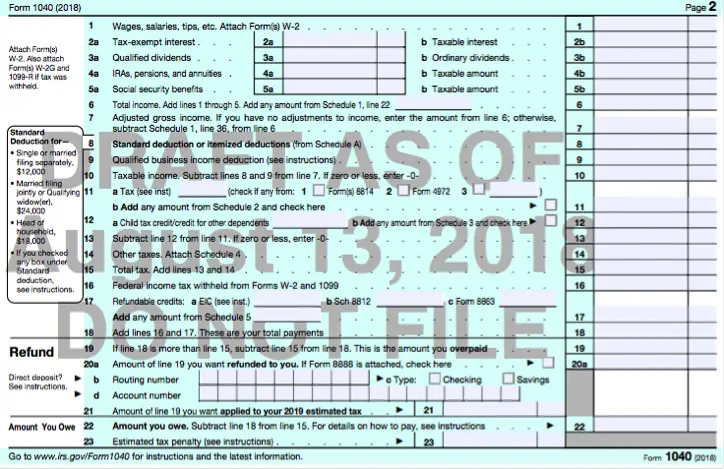

The new 1040 form is basically two half-pages. The first page (i.e. the front of the postcard) is mainly for personal information – such as your name, Social Security Number (SSN), address, dependents, and signature. The second page (i.e. the back of the postcard) is where you report your types of income, tax deductions, tax credits, and tax refund.

|

|

Here’s an overview of some items that changed with the new 1040 versus items that remained (mostly) the same:

Dependents

The new 1040 still allows you to enter up to 4 dependents. If you have more than 4 qualified dependents, you will need to add another page to your federal income tax returns.

Personal Exemptions

All of the personal exemption amounts have been eliminated for tax year 2018 through tax year 2025. Therefore, this section has been removed from the 1040 return altogether.

Reporting Income

On the old 1040 form, there were separate sections for Income, Adjusted Gross Income, Tax and Credits, Other Taxes, and Payments. The new 1040 has consolidated all of these into one section, starting with your wages and additional income, and then it has you calculate your total income and adjusted gross income (AGI) on line 11. Next, you report your deductions (including standard, itemized deductions, educator expense, and qualified business income deduction) and calculate your income taxes.

Tax Credits

On the new 1040, the Child Dependent Tax Credit is reported on Line 19, and includes a new form as well: Schedule 3. Refundable tax credits, such as the Earned Income Credit, require an additional attachment of Schedule EIC.

Tax Payments

With the new 1040, you will begin entering your tax payments on Line 16. After you calculate your total payments, you’ll move on to the “Refund” section. If you owe tax, you will enter that amount on Line 37. The IRS still offers the same payment options – including payment by check or money order, Electronic Funds Withdrawal (if you e-file online ), and credit or debit card.

Tax Refunds

The “Refund” section is essentially the same on the new 1040 as it was on the old 1040 form. Here, you can enter your bank account information if you want your tax refund issued via Direct Deposit.

New Tax Schedules – Attachments for Your 1040

Many of the old federal forms known as schedules (e.g., Schedule A, Schedule C, Schedule K-1) are still being used, so the IRS is assigning numbers to the new schedules. Here are some of the new supplemental schedules introduced after the 1040 Form changes took effect during tax year 2018:

Schedule 2

Here is the draft version of Schedule 2 (Form 1040), Tax. The Schedule 2 form is used to report additional taxes broken into two parts. Part one of the form is to report Alternative Minimum Tax (AMT) and excess Premium Tax Credit repayment for health insurance purchased through the health insurance marketplace.

Part two of the form is used to report self-employment taxes, unreported social security and Medicare tax, additional tax on IRAs or other tax-favored accounts, household employment taxes, repayment of first-time home buyer credit, and section 965 net tax liability for foreign corporations.

Schedule 3

Here is the draft version of Schedule 3 (Form 1040). This form is used to report additional credits and payments, split into two parts: refundable and non-refundable credits. Nonrefundable tax credits to report include the Foreign Tax Credit, the Credit for Child and Dependent Care Expenses, education tax credits, and the Residential Energy Efficiency Tax Credit. Other credits include overpaid taxes in previous years or previously made social security tax payment in excess.

Schedule 4

Here is the draft version of Schedule 4 (Form 1040), Other Taxes. This schedule is used to report items such as self-employment tax, household employment taxes, and the health care “individual responsibility” tax.

Schedule 5

Here is the draft version of Schedule 5 (Form 1040), Other Payments and Refundable Credits. This schedule is used to enter any estimated tax payments that you made during the year, and report refundable credits such as the Net Premium Tax Credit and the Credit for Federal Tax Paid on Fuels.

From the looks of it, nearly everyone will need to include additional schedules/forms as attachments with their new 1040 return. So does this really simplify the process? Let us know after you’ve filed next year.

Where to send your Form 1040

For taxpayers and tax professionals filing any of the new 1040 Forms, you can either e-file online or submit a paper filing by mailing your documents. Visit the IRS website to view the table of specific filing locations to find the mailing address to send your Form 1040 to if you are not filing online.