Topics

Blog

The Real Answer: “I’m a Single Parent: How Many Allowances Should I Put on My Form W-4?”

1 or 0? But the answer is, there's an art to doing your taxes. If you are a single parent with one child and are…

The Care Credit Calculator: How Uncle Sam Helps Watch Your Kids and Dependents While You Work

Uncle Sam's watching the kids. As in, paying someone to help watch them. So, like most uncles? The Child and Dependent Care Tax Credit is…

What’s the Non-Refundable Child and Dependent Care Tax Credit for and What Does It Mean for Working Families?

One more reason to love those adorable bundles of tax breaks. The non-refundable Child and Dependent Care Tax Credit is designed to ease the financial…

The Civil Side of Retirement: Your Paycheck and the Federal Insurance Contributions Act (FICA)

What the FICA? If I earn $160,201, I don't have to pay into Social Security? FICA or the Federal Insurance Contributions Act requires both employees…

Capital Gains Taxes Really Do Apply to Inherited Property: Here’s How and How to Minimize Them

It's sad they passed away, but they left you a house. Selling it may hit you with capital gains, but you can minimize them. What…

So Much to Gain: What Are the Short-Term and Long-Term Capital Gains Tax Rates? Income Thresholds, Tax Brackets and More

High income thresholds mean I earn more without paying as much in capital gains taxes? Score! Oh, wait, that’s just inflation. The capital gains tax…

How Can You File Taxes Without a W-2 Form? It’s Possible, and Here’s How to Do Your Taxes Without a W-2

So the ol' "Dog ate my W-2" excuse won't work? Filing your taxes can be a daunting task, especially when you do not have all…

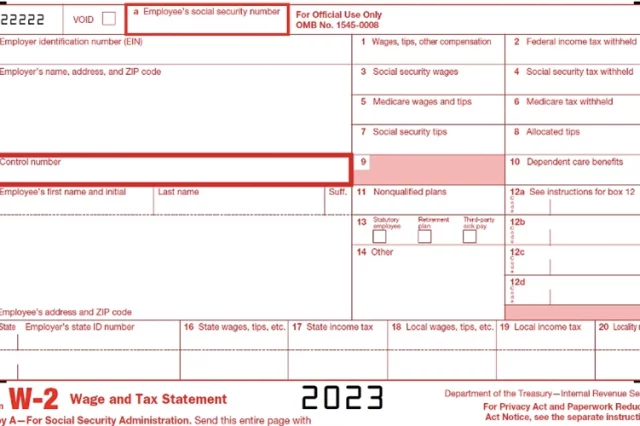

Big Questions, Small Form: What’s Box-D on Form W-2? Where Is It, What’s It for, and Can It Be Left Blank?

Is there a name for hypochondria about your tax forms? I've wondered about Box D on W-2, but now, I don't! Box D on Form…