How to Get a Tax Extension

Published:

It is easier to get a tax extension than many people believe. Once you know how to do it, you will be able to file for an extension anytime it is necessary. While it is not a good idea to rely on filing extensions every year, you never know when you are going to need a little bit extra time to file your tax return.

Before we go any further, it is important to remember this one important detail: a tax extension only gives you more time to file your return. It does not give you more time to pay any taxes that you might owe. Your payment must still be submitted by the original due date of your tax return (typically April 15th). If you need a tax extension, the following five steps will help you:

1. Determine whether or not you are going to owe more taxes. If you are due a tax refund, the filing process is much less stressful because you don’t have to request extra time. On the other hand, if you owe additional money you will need to file a tax extension while also arranging to make a payment.

2. Obtain a copy of IRS Tax Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return). This one-page form will help you get a six month automatic extension to file your taxes. You can call the IRS to request this form or print it out online. If you are working with a tax professional, they can supply you with a tax extension form as well as any others that you may need.

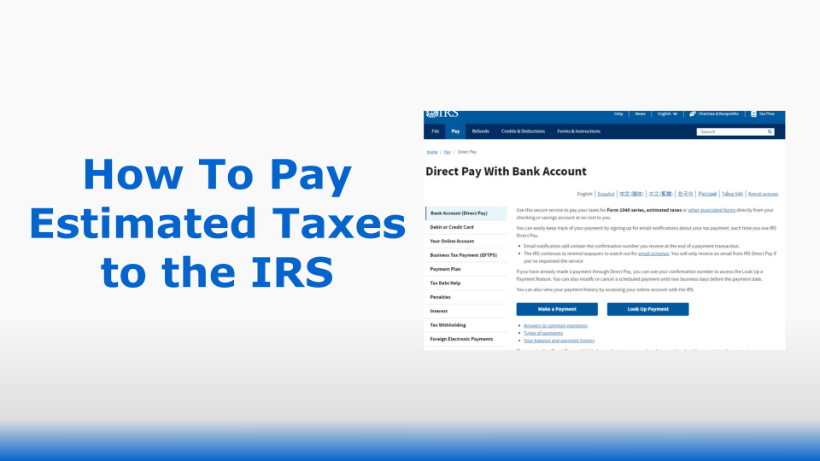

3. File Tax Form 4868 with the IRS. Fill out Tax Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) and submit it to the IRS by the due date, which is April 15. Note that Form 4868 can be filed electronically or by paper mail.

4. Pay all or part of the income tax that you owe. It would be in your best interest to pay in full, but sometimes this is not possible. Again, you are not buying yourself more time to pay your taxes when you file for a tax extension. The longer you wait to pay, the more you will owe in late fees.

5. File your tax return by the new due date. Now that you have filed for a tax extension, your new deadline is October 15th of the same tax year.

While six extra months may seem like a long time, you still shouldn’t want to wait until the last moment to file. The IRS makes it easy to get a tax extension and does not require information on why you need more time to file. If you are interested in requesting an extension, the above steps can help guide you.