How to File a Tax Return: Get Started Here

Published:Prepare your tax return at E-file.com

File your IRS taxes online quickly & accurately in just minutes with E-file.com.

Time for a tax return to basics. Form 1040: How to File a Tax Return

You have several options for filing your federal income tax return. The first step is to gather all necessary documents, including your W-2 forms, 1099 forms, and any other income or deduction records. You can file your return electronically using tax software or by mailing a paper return. If you have a low income, you may qualify for free filing assistance through the IRS Free File program or other volunteer organizations.

When determining whether to file, keep in mind the standard deduction threshold. Even if your income is below the threshold, it may still be beneficial to file a return, as you may be eligible for various tax credits, such as the Earned Income Tax Credit or the Child Tax Credit. If you owe taxes, pay the amount due by the filing deadline to avoid penalties and interest. If you are due a refund, consider having it direct deposited into your bank account for the fastest delivery.Whether you’re preparing for tax season or just want to have everything in order for future reference, having a system in place for organizing your tax-related paperwork is essential.

You can file your federal income tax return by following these steps:

1. Determine how you want to file – whether it’s electronically using tax software or through the mail with paper forms.

2. Gather all necessary documents, such as W-2s, 1099s, and any other income or deduction records.

3. Choose the correct filing status, which can affect your standard deduction and tax rate.

4. Calculate your income, deductions, and credits to determine your tax liability.

5. If you have a low income, you may still benefit from filing a return, especially if you are eligible for refundable tax credits like the Earned Income Tax Credit.

6. Consider the standard deduction threshold. Even if your income is below this threshold, filing a return may still be beneficial if you’re eligible for credits or rebates.

Organize All Your Tax Records and Documents

You know how stressful tax season can be, especially when you’re scrambling to gather all the necessary documents and records. Organizing your tax records and documents ahead of time can save you a lot of time and frustration when it comes to filing your taxes so you can get the tax breaks from itemized deductions as well as any other tax deductions you could claim. Accurate records are how you get the biggest refund.

By taking the time to sort through and categorize all your important financial paperwork, you can ensure that you have everything you need to accurately and efficiently complete your tax return for the biggest refund.

Get Your Social Security Number and ITIN

You can apply for a Social Security Number (SSN) by visiting a local Social Security office with the required documents, such as proof of identity, age, and U.S. citizenship or lawful immigration status. After submitting the application, you will receive your SSN card in the mail.

If you are not eligible for a SSN, you can apply for an Individual Taxpayer Identification Number (ITIN) by completing Form W-7 and submitting it to the IRS along with your tax return. The process for obtaining an ITIN does not require you to visit a government office, and you can do it through the mail.

ITINs expire if they are not used on a federal income tax return for three consecutive years. To renew an ITIN, you must submit a Form W-7 and attach the necessary documents.

For assistance with filing your tax return using an ITIN, contact the IRS or a tax professional. They can provide guidance and ensure that you meet all tax requirements.

Get Your W-2s, 1099s, and Other Income Records

You need to gather all your Forms W-2 from your employer(s) and any Forms 1099 from banks and other payers. If you worked in the gig economy, make sure to gather any Form 1099-K, 1099-MISC, W-2, or other income statements. Don’t forget about your Form 1099-INT and any other income documents. Also, make sure to keep records of your digital asset transactions.

In addition to these income records, make sure to also have your Form 1095-A if you had Marketplace coverage. It’s also important to gather any IRS or other agency letters you may have received, as well as the CP01A Notice.

Choose the Filing Status That Fits Your Tax Situation

You have several options when it comes to choosing the right filing status for your tax situation. Your marital status and household arrangements will determine which filing statuses may apply to you. These include:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er) with Dependent Child

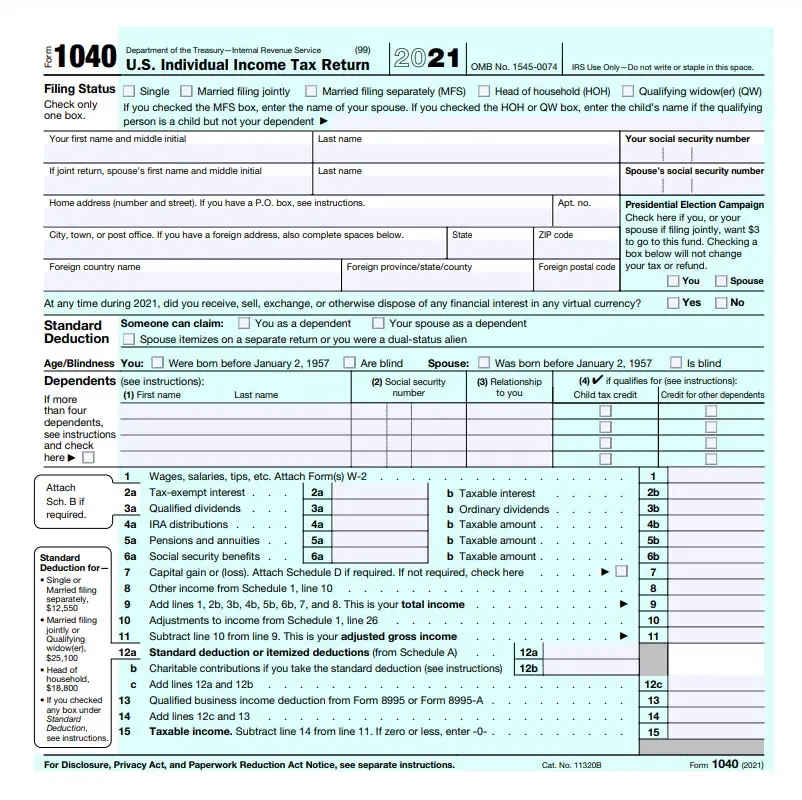

Prepare Your Federal Tax Return With the Right Forms

You need to gather the necessary IRS forms to prepare your federal tax return accurately. Start with Form 1040, the standard form for individual income tax. If you’re a senior, you may use Form 1040-SR instead. If you make estimated tax payments, you’ll also need to include Form 1040-ES.

Here’s what the form looks like so you understand what information you’ll need to provide:

FORM 1040 (FRONT):

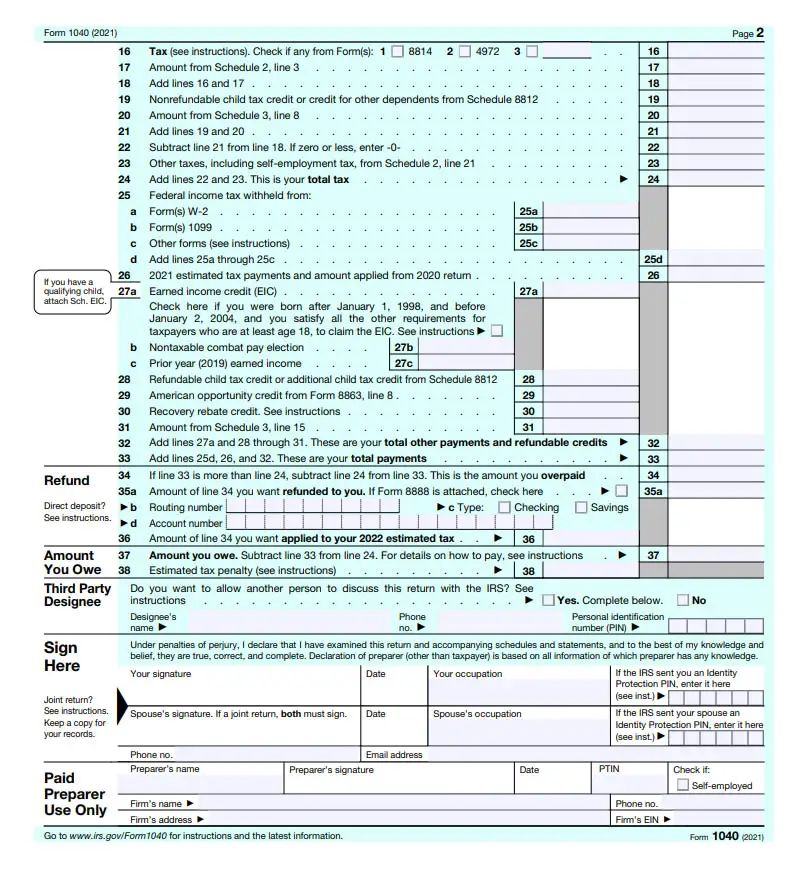

FORM 1040 (BACK):

Additionally, gather any other forms specific to your circumstances, such as Form W-2 for wages and Form 1099-MISC or Form 1099-NEC for additional income.

If you’re unsure about which federal forms to use, visit the IRS website or contact the IRS for assistance. Being thorough and accurate with the forms you use will help ensure that you file your taxes correctly and get any eligible refunds or credits. Don’t forget to double-check that you have all the necessary forms before starting your tax return to avoid delays or calculation errors.

Don’t forget to include all relevant keywords, such as IRS forms, federal tax return, Form 1040, Form W-2, and Form 1099 when searching for the necessary documentation.

Common Income Sources That Are Taxed

You may have different types of income that are subject to taxation. Wages, which are the earnings you receive from your employment, are generally reported on a W-2 form.

Dividends from stocks and investments, self-employment income, royalty income from creative works, and capital gains from the sale of assets are also sources of income that are taxed. Dividend income is typically reported on various forms such as the 1099-DIV, Schedule C, Schedule E, and Schedule D.

This includes alimony received, wages paid to household employees, and taxable scholarships and grants. Alimony is reported as income on your tax return, household employee wages are reported on a Schedule H, and taxable scholarships and grants are reported on the tax return as well. Be sure to use the self-employed tax forms if you’re running your own business so you schedule tax payments year round.

If you work in another country, you may receive foreign employment income that’s still subject to U.S. federal income tax rates.

Common Expenses You Should Track to Claim Big Tax Deductions

You should track several common tax-deductible expenses in order to claim on your tax returns. Even a simple tax filing can include education expenses, business expenses, qualified business income (QBI) deduction, self-employed retirement contributions, employee business expenses, depreciation expenses, home office deductions, and donations to charities.

Additionally, it’s important to track any depreciation expenses for business assets, as this can also lead to significant tax savings. If you have a home office, be sure to track and calculate the home office deduction, which can help reduce your taxable income. Lastly, keep records of any donations you make to charities, as these can also be tax-deductible.

Not everyone has business deductions, but odds are you may have a few work related expenses that you can claim this tax filing season.

Pick a Tax Filing Method (The IRS Wants You to E-File)

Whether you choose to use online tax preparation software or file directly through the IRS website, there are important considerations to keep in mind. The benefits of e-filing, the different methods available to you, and why the IRS urges American taxpayers to file with online tax software.

Let’s explore the options for tax return filing and the advantages of e-filing this tax filing season.

Why Filing a Paper Tax Return Isn’t the Best Option

You should consider filing your taxes online or hiring a professional tax preparer instead of mailing in a federal return. Online filing and using a tax professional offer numerous benefits that can make the process easier and more accurate.

Filing taxes online is convenient as you can do it from the comfort of your own home and at any time that suits you. Additionally, online filing software can help ensure a more accurate return, reducing the chance of calculation errors that could result in penalties or delays. Not to mention, you might spend less time filing taxes than if you had spent that time organizing paper forms. Plus, by filing online, you may be able to access tax credits and deductions that you may have overlooked on a paper return, potentially leading to increased refunds.

Hiring a professional tax expert also offers the benefit of accuracy and expertise. Tax return preparers can navigate complex tax laws and regulations, maximizing your actual deductions and ensuring your tax return filings stay accurate year after year. They can also provide valuable advice on tax planning and preparation for the future to minimize future tax liabilities. .

On the other hand, mailing in a paper return can be time-consuming and prone to calculation errors, potentially leading to delays in processing and receiving your refund. Overall, online filing or using a tax return preparers can save you time, improve accuracy, and potentially result in a higher federal refund, making them the better options for filing your taxes.

Tell the IRS How to Pay Your Tax Refund

You have successfully filed your taxes and are now eagerly awaiting your federal tax refund. However, you may be wondering how you will receive this refund and whether there are any options for how it can be paid out.

You can tell the IRS how to pay your federal tax refund, including direct deposit or a paper check.

Pros and Cons of a Direct Deposit or Paper Check from the IRS

You have two options for receiving your tax refund from the IRS: direct deposit or a paper check. Direct deposit offers the fastest refund given the average tax refund time frames of a few days after your tax return was processed. It’s also a secure method of delivery, reducing the risk of the check being lost or stolen.

However, if you don’t have a bank account, a paper check is the only choice, though it may take longer to arrive by mail.

Filing a tax return, even if not required, can still benefit you by making you eligible for certain tax credits, receiving a refund, or qualifying for financial assistance programs. Different financial institutions or programs may impact your choice between direct deposit and a paper check, so it’s important to consider your individual circumstances.

Make a Payment if You Owe Taxes to the IRS

You have several options for making a payment to the IRS if you owe taxes. One option is to make an electronic payment through the IRS website or use the IRS2Go mobile app. You can also make a wire transfer, or use a debit or credit card for your payment. If you prefer, you can mail a check to the U.S. Treasury.

If you are unable to pay the full amount immediately, you can set up an IRS payment plan to pay your federal tax bill over time, to avoid additional penalties and interest.

To contact the IRS for help with filing your tax return, you can visit the IRS website, call the IRS customer service line, or visit your local IRS office. You can also seek assistance from a tax professional to help you navigate the process.

No matter your situation, it’s important to address your IRS payment obligations and seek assistance if needed, to ensure you are in compliance with your tax responsibilities.